Simple Budget Planning Strategies

How do you manage to organize your time and budget in this busy world today? Is there such thing as simple budget planning strategies? With the high costs of living and our constantly fluctuating financial situation, it’s hard to save and organize our budget. So how do we put together a realistic budget? The following ideas will help you get started…

Creating a budget that will meet all your expenses, and yet still allow you to save…sounds impossible, right? But with these simple budget planning strategies, you can make it happen. For starters, we start with the little things. Instead of eating out every night, we do it less. It’s not about cutting out everything completely, but minimizing them, and helping us save money and improve our finances. We apply this same principle to just about everything and watch them add up. There are loans that can help you with your budget, especially if you have a business, home, or other assets.

There are many ways we can create a successful plan to improve our financial situations, and here are our Simple Budget Planning Strategies for 2017 that will help you get there.

Keep track of your expenses

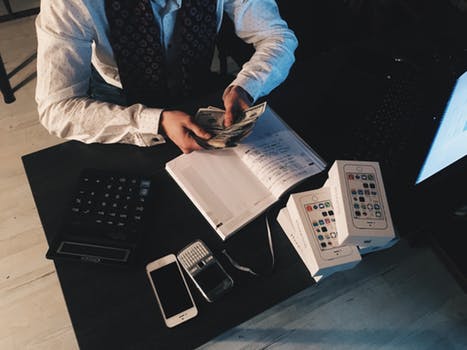

The first and most important step in creating a realistic budget is to keep track of your spending. This way, you know how much you’re spending, and on what. If the previous week you spent more than usual, the following week you will try to be more responsible. You will learn your spending patterns, and learn what needs to be cut out. Don’t waste your money on luxuries like expensive devices, new phones, laptops, clothes, etc. Write everything down, paper and pen if it makes it easier for you. Every purchase needs to be recorded, so you know how much you can spend and how you for savings. You can still live pretty regularly (if not better) without some of the ‘luxuries’ you may have been used to do.

Put money away

What is the best way to save? Put money aside, no matter how small it is. It will get you in the habit of saving, and before you know it, it will add up. If you have money automatically put into your savings account, you won’t miss it as much. That way, before you start spending, you already have an allotted amount/budget that you can spend. It is always good to have extra in your savings account.

Determine your priorities

The most important thing about spending is to factor in your priorities. Taxes, mortgage payments, electricity bills, and similar costs require payments every month, so these are the expenses that you must cover. Aside from this, you need money for food and other living expenses, which are also priorities you can’t escape from. Entertainment and going out can be curtailed, and there are plenty of things to do for free. Instead of going to the movies, you can get a Netflix account for $8, and watch unlimited movies for a month. Things like that.

Pay debts on time

If you have taken out any loans, it is better to pay them off sooner, especially if your interest rates are rising. Regardless of how quickly you pay them off, make sure to pay them on time. Plan this into your budget, and have it come out of your account automatically if you can. Pay a little more than is required whenever possible. Paying them off earlier will save you money.

Create a safety net

It is important to always have money in your savings account for rainy days. Your finances are done right only when you check your account and you can put a smile on your face, knowing that you are safe and secure. This is good for not only your financial situation but your piece of mind.

Living within your means

Sometimes we get carried away. Sometimes we forget to check ourselves when making purchases. Living within our means doesn’t mean we have to stop spending money altogether, it means to spend less, and spend more responsibly. Everything is balance, and that includes your budget and savings account.

Following these simple budget planning strategies – and you should start to see an immediate difference.